I can't pinpoint the exact moment where my interests in Magic: The Gathering turned from being a purely casual tabletop player to those of a collector. It probably involved revisiting the game, after one of the many "breaks" I've taken, and discovering that cards in my collection actually held some serious value. Mind you, I was aware of value from the start [for me], during 3rd/Revised Edition. Inquest was a constant. Only, when returning to the game that specific time, I felt the necessity to go on lock down: sleeve, protect, and store my cards. They were worth too much to play with! I took many more breaks through the years, but this factor remained absolute whenever I came back to it.

Like Now.

And like back then, I don't sell (and have rarely traded cards) from my collection, despite the desire to do so for years. I keep telling myself it'll happen soon — this lucrative, yet unlikely, business of making money through Magic. To do so, one has to invest money and/or be vigilant in trading/buying/selling and do so smartly. Picking optimal targets, knowing when to buy, and when to get out of a prospect all play an important role. Having the proper channels helps too.

Most of this is common sense and yet I fall short on almost all of these fronts.

Regardless, I've dabbled with speculating. Mostly on Magic Online, but sometimes in paper. I find it exciting even though I suck at it. I wasn't aware of #MTGFinance until roughly two years ago. Never knew the community existed, but I suppose knowing intuitively that it must. I was infatuated with what new knowledge I would glean from those more familiar with the system, those more dedicated and aggressive.

Back in My Day

Back when I happened upon this sect of Magic players, I don't remember there being so many articles as there are today. Naturally this is due to growth within the community, and individuals capitalizing on the opportunity to write (or create podcasts) about the topic; filling the minds of eager, ambitious newcomers to their world with masked promises of riches.

People like me.

Thankfully, the constant self-induced poverty I constantly find myself in saved me from throwing too much money into specific spec targets. I would instead just follow along with the Twitter hashtag and take in whatever information spewed forth. What cards were prominent during events, especially on screen and/or Top 8s, and which cards you should be scooping up in trades and buying from local game stores, before others realized they may be holding the "next big thing". It all seemed generally harmless...

However, it wasn't long into my stint with the #MTGFinance community before I caught the first glimpse of the fracture that lurked within. The dissent of players over the "business practices" of some speculators (or just how it works in general). Particularly when certain cards were bought out, at times — it was believed — by coordinated buyouts, for the sole purpose of artificially jacking up prices and manipulating the market. It didn't help that many of these specs were featured in Magic finance related articles/podcasts. These speculators would then sell back into the hype/price spikes as people, taking advice from said articles, were attempting to buy into it.

Or so the story goes. Naturally, the finance community denied any and all involvement in said activities.

To be honest, my relationship with #MTGFinance quickly became one of purely entertainment purposes. I would read articles and watch debates rage openly over twitter and elsewhere online. Each was the same old song and dance: players accusing #MTGFinance of these buyout methods, while those prominent (at the time) within the finance community being flippant and dismissive of any such thing, claiming it would be impossible to move such a volume of cards needed to manipulate the market. That it was ridiculous to believe that there was a cabal puppeteering the masses, herding sheep in a specific investment direction. That that simply wasn't the way #MTGFinance worked.

Nevermind the blatant calls for buyouts within the community. Just, you know, the public ones. But be damned if any were done in the backdrop, in secret, "behind the curtain" by chummy speculators.

Nevermind the very blatant card spikes that took place in the span of a single day.

Nevermind the blatant gloating of speculators on their profits. Ones who would write about specific spec targets and then sell out during the hype/spike.

As you can imagine, none of these factors (among others), did much to quell the passionate disdain people in the Magic community had for #MTGFinance.

Now in My Day

Unfortunately, things aren't much different. Sure, things have changed, but they remain the same. #MTGFinance is a lot more quiet than I remember it being, and there may have been a slight changing of the guard, so to speak, but that tension and stigma surrounding the community is still alive. Possibly more so. Or maybe I've just caught another resurgence of the issue among those in both the Magic and #MTGFinance communities. Debates still rage on. Lines still drawn. Sides chosen.

Dramatic I know.

But there are some players who feel that #MTGFinance is literally damaging the game. In some ways, maybe it is. Price spikes, like the ones caused by buyouts, make it hard for some players to buy into Magic formats, whether competitive or casual. That's reason enough to understand why people have such outspoken, negative opinions about finance and speculation.

I get tired of hearing arguments about capitalism, free market, supply and demand, etc. I get it, you can do what you want. I'm not big on Economics. I don't pretend to know much about the subject, much like how I don't claim to be knowledgeable about making sound speculative picks in Magic.

That doesn't mean I (or the rest of the community, for that matter) am completely clueless. And that also means that just because you can do it, you should, or that if you do, there won't be repercussions.

Do I think #MTGFinance could lead to the end of Magic? Of course not. Does anyone really actually think that? Maybe figuratively for themselves. They may quit/bow out, discouraged at how much it will cost them to participate at certain levels. Do I think people have the right to bitch and complain about this subset of the Magic community? Yes, I do, and I think many have valid concerns.

Concerns those currently prominent in #MTGFinance still scoff at.

Do You Believe in Buyouts, 'Cause I Hope You Do

More than anything else, I guess I become most frustrated around the arguments that buyouts and manipulation of the market are impossible to achieve. And that even if they did exist, there would still need to be that demand present, to capitalize on, to make profits. If speculators can sell at the new price, then there exists that demand and it's merely a price adjustment. Otherwise speculators, or those pushing for buyouts, would be tying their own financial nooses.

At this point, I think it's been proven that such attempts have been orchestrated in the past, again, publicly, and that it's still a method used today. It may not be announced like they used to be, but I feel that if watching trends, you can tell when a particular card is bought out and artificially spikes, compared to cards backed by real demand. Really, whether they are planned or not is irrelevant, in terms of the affect they have on the market. They happen and I feel that's just simply a fact.

In regards to real demand and price increases, if looking at a chart showing the price history of a card, if there's a gradual climb, it's a more natural price growth. If it suddenly spikes in the matter of a day or two, it's likely artificial.

Many try to argue various factors on why a card would spike so sharply in a day or two. New secret tech revealed, a Grand Prix, a Pro Tour, set rotations, etc etc blah blah whatever. They claim there is real demand and that explains the price shift. Otherwise it wouldn't maintain the new price (and, admittedly, sometimes they don't, which is also reflected in a steep decline in price after a spike — so wouldn't that alone be proof of the practice?). This isn't always the case, however. Some cards retain their new costs, giving the illusion that the card is in demand and selling at that price. These cards may gradually dip over a long period time. However, other cards, strangely enough, maintain their new price tag without any demand at all.

Commanding Tiny Terrors

I think older Commander/Tiny Leaders staples and foils are a good example of this.

I watched the Tiny Leader debacle unfold via #MTGFinance when the format was having some new life breathed into it. Like vultures, speculators (myself included) clamored around, picking at the remains of whatever cards they thought may be popular in the format (full disclosure: I got none, zero, zip, zilch). Prices were spiking all over the place, foils especially. I feel these cards readily expose buyouts in action, and their affect on the market and community. Now, people will argue that Tiny Leaders has many issues outside of pricing/pimping out a deck (and I can't disagree), but an outrageous Commander/General price point doesn't help either.

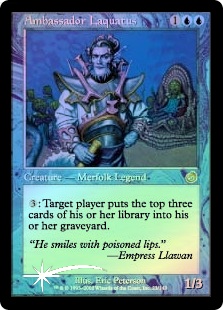

I still remember buyouts of foil Ambassador Laquatus, a popular Tiny Leaders general. Suddenly they were 40$ or 80$ or something (I think I took a screenshot, but if I did it's on my old computer). Whatever it landed at was ridiculous. Thankfully, over time it dropped again, but it's just one of many examples where cards of little supply like this can maintain a price spike, even though no one is buying.

The same can be observed with various staple Commander/EDH foils over time.

Casual Casualties

The reason I mention these casual formats is because casual players make up, by far, the largest population of the Magic Community. And it's these average, everyday casual players who are among the most vocal against #MTGFinance. Sure, competitive players get upset too, but many of them are familiar with the finance aspect of Magic. Casuals, however, not so much.

How many Magic players are there? 12 Million? 15 Million? Somewhere in between? More?

How many players play at a competitive level such as Grand Prixs and Pro Tours? Attendance has been growing steadily for a long time, and GP Vegas 2015 hit somewhere around 8k players? That's double the previous Vegas GP in 2013. So eight thousand competitors breaking records and making Magic history. Let's just round it to 10k, knowing that a good majority of those players play in other Grand Prix and Pro Tours making up their attendance numbers (and I would assume tournaments hosted by other organizations). Out of that 12 Million+ playerbase, even if doubling that five times over, it's just a drop in the bucket.

Casual players, for the most part, don't care about competitive magic. Many competitive Magic players play casual formats, but rarely do purely casual players bother with competitive ones. Not even FNM, which is about as casual competitive Magic currently gets. They don't constantly, if ever, watch the Magic pricing market. They don't follow along with competitive coverage, worrying about which decks make Top 8 and the cards they comprise of.

Furthermore, they [Casuals] aren't sitting at their computers, chomping at the bit, waiting to buy into cards that make frequent Top 8 standings. They don't pay attention to that shit. So who are? Speculators? More than likely a good majority. What exactly is the demand that happens the day a card is featured in multiple Top 8 decks? Suddenly everyone and their mother supposedly wants to play that specific deck? Is it believed that that's how the competitive scene works? Maybe it does and I am, indeed, completely clueless...?

Which has a deeper impact on card prices: a few individuals buying up to a playset of a card they would like to try out in a deck they've assembled after reviewing tournament footage, or a few individuals buying 50-100+ of said chosen card. Claiming that there are thousands of any given card out there is true to some extent, but also, you have to remove the majority chunk of cards owned by casuals, because their cards aren't on the market. And their chunk is huge.

Claiming that buying out sites, such as Star City Games (SCG), doesn't impact the overall price of a card (unless there is demand) isn't necessarily true. Once a card is sold out, most retailers then consider increasing prices, SCG included. Like it or not, sites like SCG, regardless of how overpriced people bitch about them being, set a market standard. Once they raise their prices, other retailers will follow suit (it's like this on Magic Online too, except now many bots in the system are programmed to increase prices as cards are being bought and sold, avoiding the need to be manually adjusted).

I know very, very few retailers (in my area, mind you) that use TCGPlayer pricing over SCG, if they use one. And if a retailer can raise their prices and make more money, over waiting to see if there will be any demand before doing so, what exactly do you believe they'll do? Will sellers, whether speculators or not, raise hell because there isn't really demand, or will they attempt to sell into the inflated prices? Sell into the hype. But there has to be some demand, right? Thankfully, some speculators drum up the hype themselves to drive said demand. Even still, as I tried explaining, a lot of the time the inflated price point sticks around for a while, leaving people no choice if wanting to build a specific deck to play.

Yeah yeah, you always have a choice, whatever, you know exactly what I mean.

As for casual players, they come into the picture long after the fact, and completely independent from it. They see a friend playing a deck with a card they think is sweet. Or learn of a new Commander/General option. Or hears of a new format being talked about and they want to give it a shot. So they look into the card(s)/format(s) and see that they are sitting at astronomical prices. Odder yet, a good handful aren't even regularly played, or if they are, not putting up any consistent numbers that would justify the price they currently sit at.

So they either have to suck it up and buy in at inflated prices, or let it go, hoping prices will drop at some point down the road. But sometimes someone will inquire and learn of the notorious #MTGFinance sector of the Magic community. They check for themselves, through various mediums, just what this group is about. And what they see doesn't sit well with them. And they aren't alone.

The Truth of the Matter

It may sound like I have some serious beef with the #MTGFinance community at large, but really I don't. As I've said, I love speculating. Never liked intentional buyouts, though. However, I've never felt like I've been screwed over by the group. But again, I enjoy speculation, and don't really buy singles much outside of that reason.

Either way, I don't believe they're Monsters. Not most of them anyhow...

In fact, lately, many within the Magic finance community have been attempting to change the perception others have when it comes to their group. Earlier when I said it's been quiet, what dominated most discussions was this said negative perception and stigma people hold against the #MTGFinance community. Before the new set, Battle for Zendikar, was being released that is. Then it was back to business as usual.

These individuals claim they wish nothing more than to help teach finance within Magic. Help others learn the tricks of the trade so they can make some money through the game they love, sans competitive play. They claim transparency. But I feel to offer transparency it's literally an all or nothing offer. Partial transparency only triggers further distrust. If you can't provide it fully, it's best to not offer it at all. You'll potentially widen the gap between you and your audience, or students, or however you like to think of them as.

The sad, unfortunate truth of it, though, is that #MTGFinance can do all of this, and more, but they will still bear that scarlet letter (would it be "B" for Buyout, "F" for Finance, or "S" for Speculation, or...), because like it or not, they won't be able to please everyone. Even the transparency itself is almost a catch-22. You show people upfront what you are buying/selling and why, and people will get upset at the info. You hide it all and people will still get upset, knowing it's happening regardless. But I feel that even in the face of those issues the community could grow into one of integrity.

There is an audience, there's the desire to make money through this passion/hobby, and there are some talented people willing to share their knowledge and experience.

One caveat, though: if you want so badly to change the way people view #MTGFinance, but you continue to deny facets of known practices within the community (whether in the past or present) and remain insistent about keeping up flippant, ridiculing rhetoric over these concerns; write articles asking why there exists such a negative perception about the community but then arrogantly talk down and act condescending to these people; brag about specs and articles written about yourselves and then proceed to pat yourselves on the back digitally over Twitter in douchecanoe-circlejerk fashion; I'm going to have to say I think you're doing it wrong.

Just my opinion.

Either you love the #MTGFinance community enough to do what you can to change the negative perception of it or you don't. You can't really half-ass it. You get what you put in... as they say.

And remember: Friends don't let friends call the new BFZ dual lands Battle Lands...

Are you familiar with the #MTGFinance community? If so, what are your thoughts of it? Have any specific experiences with the community you want to share? Do you love or hate speculating? Any experiences (failures or successes) you'd like to share?

Do you feel buyouts can indeed cause inflation in card prices? Do you believe (or know... dun Dun DUN) some buyouts are orchestrated? Do you believe there exists a secret Cabal?! Do You know their members?!?! Will you call them out and expose them to the Light?!?!?!

I CAN PROTECT YOU!!

But not really...

Why do you feel #MTGFinance is met with such opposition and disdain? What do you feel are some things that individuals within the #MTGFinance community can do to help change it's current negative image?

![A to Z 2017 [FLASH FICTION]: REFLECTIONS](https://images.squarespace-cdn.com/content/v1/551a2e0ee4b0bf065e1b3b3f/1494776923372-FIAN9DV6OKANFI5Q72ZD/atoz2017banner.png)

![A to Z 2017 [MAGIC MIXER]: REFLECTIONS](https://images.squarespace-cdn.com/content/v1/551a2e0ee4b0bf065e1b3b3f/1494782030429-FMJQLUEJJK850772LG6Q/atoz2017banner.png)